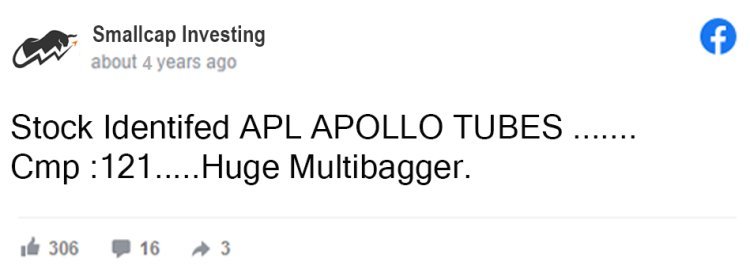

Why I bought APL APOLLO TUBE in 2019 and why it multiplied 10 times in less than 3 years?

Friends, As you all know that my criteria to filter stocks are numerous and its very difficult for a stock to pass through all my filters…. So when in Aug 2019, one company named APL Apollo Tubes Ltd passed all my filters, it was a slight surprise for me…. Market Capitalisation of the company was 3000 cores and the company was listed on NSE &BSE … But instead of ignoring this company, I decided to research further deep in the company…. I analysed the financial statements and ratio of the company from many angles and found the numbers excellant … I cross checked the numbers from different sources, read annual reports. Numbers were looking extraordinary from all perspectives and share price was not reflecting the underlying financial strength of the company, with real presence on the ground, and trading at extremely attractive prices…. Though its not possible to provide all the reasons, Below I am providing some reasons about my Bullishness of the company –

- APL Apollo Tubes Limited (APL Apollo) is one of India’s leading branded steel products manufacturers. Headquartered at Delhi NCR, the Company runs 10 manufacturing facilities churning out over 1,500 varieties of MS Black Pipes, Galvanised Tubes, Pre-Galvanised Tubes, Structural ERW Steel Tubes and Hollow Sections to serve industry applications like urban infrastructures, housing, irrigation, solar plants, greenhouses and engineering.

- Company has delivered good profit growth of 32.3% CAGR over last 5 years.

- Company has a good return on equity (ROE) track record: 3 Years ROE 25.4%

- Company's median sales growth is 23.8% of last 10 years.

- FII Stake is 25%

- APL Apollo is the 1st Company to innovate readymade Chaukhat, Fence, Plank and Hand rails as Steel for Green Concept which replaced conventional wood application in building construction

- Keeping the Steel for Green as priority APL is the 1st Company to innovate narrow and thicker color coated galvanized sheets which will save more trees

- Sales volume up by 30% YoY to 2,280k ton

- Net Profit increased by 4% to Rs6.4bn